Getting My Estate Planning Attorney To Work

About Estate Planning Attorney

Table of ContentsEstate Planning Attorney Fundamentals ExplainedIndicators on Estate Planning Attorney You Should KnowA Biased View of Estate Planning AttorneyEstate Planning Attorney Fundamentals ExplainedGetting The Estate Planning Attorney To WorkAn Unbiased View of Estate Planning AttorneyThe Estate Planning Attorney Diaries

We additionally established up depends on That you can avoid Massachusetts probate and shelter your estate from estate tax obligations whenever possible. We can additionally make sure that liked ones who are unable to live separately are attended to with a unique requirements count on. At Facility for Elder Legislation & Estate Preparation, we understand that it can be challenging to think and speak about what will certainly take place after you pass away.We can assist. Call and establish a complimentary examination. You can additionally reach us online. Serving the better Boston and eastern Massachusetts areas for over three decades.

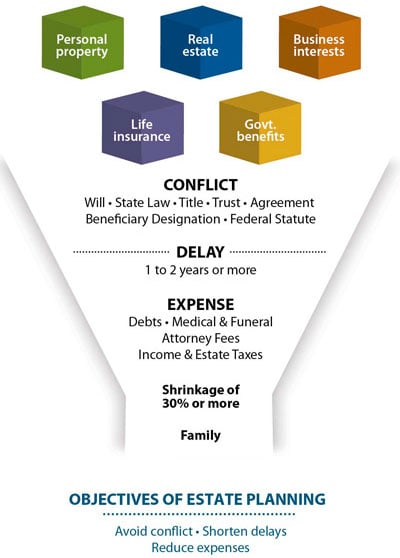

They help you develop an extensive estate strategy that lines up with your desires and goals. Estate preparing attorneys can help you stay clear of blunders that can invalidate your estate plan or lead to unplanned effects.

Unknown Facts About Estate Planning Attorney

Working with an estate planning attorney can aid you prevent probate entirely, conserving time, and money. An estate planning attorney can assist safeguard your possessions from suits, lenders, and various other insurance claims.

Cloud, Minnesota, connect to today. To get more information regarding bankruptcy,. To discover real estate,. To discover wills and estate preparation,. To call us, or call us at.

The age of bulk in a provided state is set by state regulations; typically, the age is 18 or 21. Some possessions can be dispersed by the establishment, such as a financial institution or brokerage firm, that holds them, so long as the owner has supplied the appropriate directions to the economic establishment and has actually named the beneficiaries who will certainly obtain those possessions.

More About Estate Planning Attorney

For instance, if a recipient is named in a transfer on death (TOD) account at a broker agent firm, or payable on death (SHEATHING) account at a bank or lending institution, the account can generally pass directly to the beneficiary without experiencing probate, and thus bypass a will. In some states, a comparable recipient designation can be contributed to realty, allowing that possession to likewise bypass the probate process.

When it involves estate preparation, a skilled estate attorney can be a very useful possession. Estate Planning Attorney. Functioning with an estate planning lawyer can provide numerous benefits that are not offered when trying to complete the process alone. From supplying knowledge in legal issues to aiding develop an extensive prepare for your family members's future, there are several advantages of working with an estate preparation attorney

Estate lawyers have considerable experience in comprehending the subtleties of different legal records such as wills, trusts, and tax obligation legislations which allow them to provide audio recommendations on exactly how best to safeguard your assets and guarantee they are given according to your dreams. An estate lawyer will certainly additionally be able to give advice on how best to browse intricate estate regulations in order to guarantee that your dreams are honored and your estate is taken care of appropriately.

The Main Principles Of Estate Planning Attorney

They can typically provide advice on how best to update or create brand-new documents when required. This may include recommending modifications in order to capitalize on new tax benefits, or simply guaranteeing that all appropriate records show one of the most current beneficiaries. These attorneys can also provide recurring updates related to the monitoring of counts on and other estate-related matters.

The goal is always to guarantee that all documents stays lawfully accurate and mirrors your present desires additional hints properly. A significant advantage of collaborating with an estate planning lawyer is the very useful guidance they give when it pertains to preventing probate. Probate is the legal procedure throughout which a court establishes the validity of a departed individual's will and manages the distribution of their possessions according to the regards to that will.

A skilled estate attorney can assist to guarantee that all essential records are in area which any properties are appropriately distributed according to the regards to a will, avoiding probate altogether. Inevitably, collaborating with an experienced estate preparation lawyer is one of the ideal ways to guarantee your wishes for your family's future are brought out as necessary.

They supply vital lawful assistance to guarantee that the ideal passions of any minor youngsters or adults with specials needs are totally safeguarded (Estate Planning Attorney). In such situations, an estate attorney will assist recognize ideal guardians or conservators and ensure that they are provided the authority essential to take care of the possessions and events of their fees

Not known Factual Statements About Estate Planning Attorney

Such trust funds commonly contain provisions which protect advantages received with federal government programs while permitting trustees to keep limited control over exactly how properties are taken care of in order to maximize advantages for those included. Estate lawyers comprehend just how these trusts job and can provide very useful help establishing them up correctly and making sure that they remain legitimately certified with time.

An estate planning attorney can help a moms and dad include arrangements in their will certainly for the treatment and monitoring of their small youngsters's possessions. Lauren Dowley is a skilled estate planning attorney who can assist you create a strategy that satisfies your particular demands. She will certainly deal with you to understand your assets and just how you want them to be dispersed.

Don't wait to start estate preparation! It's one of one of the most important things you can do on your own and your loved ones. With a little of initiative, you can guarantee that your final wishes are accomplished according to you. Get In Touch With Lauren Dowley today to begin!.

Some Known Incorrect Statements About Estate Planning Attorney

Producing or updating existing estate preparation files, including wills, trusts, wellness treatment regulations, powers of lawyer, and relevant devices, is among one of the most important points you can do to guarantee your wishes will certainly be recognized when you pass away, or if you come to be unable to manage your events. In today's digital age, there is no shortage of do-it-yourself options for estate planning.

Doing so might result in your estate plan not doing what you want it to do. Wills, trusts, and other estate intending files should not be something you prepare once and never ever revisit.

Probate and trust regulations are state-specific, and they do alter from time-to-time. Collaborating with an attorney can give you tranquility of mind understanding that your strategy fits within the parameters of state law. Among the greatest mistakes of taking article source a do-it-yourself method to estate planning is the threat that your papers will not truly achieve your goals.

10 Easy Facts About Estate Planning Attorney Described

They will certainly think about various scenarios with you to prepare records that properly mirror your dreams. One usual false impression is that your will certainly or trust fund instantly covers every one of your assets. The reality is that particular kinds of internet home possession and beneficiary classifications on possessions, such as retired life accounts and life insurance policy, pass independently of your will certainly or trust fund unless you take steps to make them collaborate.